Reuters / Lucas Jackson

- Agree to a Bitcoin A US ETF could pull investors out of a popular deal and undermine key support for the exorbitant cryptocurrency price. JP Morgan Strategists said on Friday.

- Institutional investors invest heavily in the Grayscale Bitcoin Trust for regulatory reasons rather than purchasing Bitcoin directly. But trust promotes a premium over the basic token.

- The SEC is expected to ratify a Bitcoin ETF in 2021. The introduction of such a fund could knock institutional investors out of Grayscale’s confidence and reduce the premium.

- While the outflows of Grayscale confidence could pose near-term pressure for bitcoin prices, JPMorgan still expects bitcoin ETFs to benefit from the cryptocurrency in the long term.

- Watch bitcoin trading live here.

Introduction a Bitcoin The US ETF is likely to withdraw investors from a popular call option and create a near-term drawdown on the token price. JP Morgan Friday said.

The SEC is expected to approve such a year for the ETF as the Biden administration brings new leadership to the agency. A regulatory mandate would boost Bitcoin’s investment case in the long run. But immediately, the approval is likely to drain investor capital from the Grayscale Bitcoin Trust, according to JPMorgan.

While retail investors typically buy bitcoin outright, institutional investors are largely buying stakes in Grayscale’s trust for regulatory reasons, according to the strategists. The fund has virtually a monopoly on the flow of institutional capital to Bitcoin, and thus enjoys a large premium for the cryptocurrency it tracks.

The team said the Bitcoin ETF will offer a replacement for the Grayscale Fund and cut the premiums the funds pay.

“The series of GBTC outflows and the collapse of their premiums are likely to have negative near-term effects on Bitcoin, given the influx and signaling the importance of GBTC,” the bank said in a note to clients.

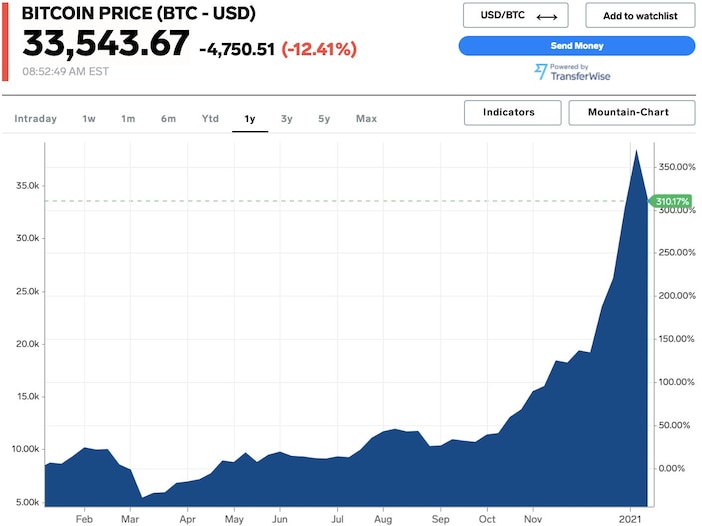

Bitcoin cooled to start the week after rising to nearly $ 42,000 on Friday. Cryptocurrency Decreased by up to 19%, To $ 30,775.26 on Monday as investors took profits from its weeks-long rally. Bitcoin has remained almost 90% higher over the past month.

Not only has JPMorgan estimated how much a bitcoin ETF could slam into, but the buying structures used by institutional investors offer some hints. A typical monetization trade for a Grayscale fund premium involves borrowing bitcoin, placing tokens in a trust fund, and receiving stocks with a six-month closing period. Then investors hedge the stake by shorting GBTC shares.

JP Morgan said some institutional investors have likely entered the liquefaction trade during the second half of 2020 with the intention to sell after the lockdown period. Strategists have estimated that approximately 15% of GBTC shares were used in the monetization trade. Once the six-month lockdown period ends, a large portion of the fund’s investors can rush to exits into the premium pocket.

The bank added that the Bitcoin ETF will only serve to intensify migration. Such a fund would undermine Grayscale’s monopoly position and could prompt more investors to leave the fund.

Bitcoin was trading at $ 33,625.67 as of 8:48 AM ET on Monday.

Now read more market coverage from Markets Insider and Business Insider:

“Професійний вирішувач проблем. Тонко чарівний любитель бекону. Геймер. Завзятий алкогольний ботанік. Музичний трейлер”